Royal Oak Apartment Market Update – November 15, 2025

Market Highlights (as of November 15, 2025)

-

Average Sold Price: Over the past 12 months, apartment-style condos in Royal Oak have achieved an average sold price of about $298,178.

-

Average Days on Market: The average time on market over the period was around 40.3 days, which reflects a more drawn-out time on market, with some homes needing extra exposure before they sell.

-

Odds of Selling: Combining completed sales and current pendings, the likelihood of a listing selling for a apartment listing in Royal Oak over this window comes in at roughly 56.1%, based on 32 sold, 0 pending, and 25 that did not sell.

-

Monthly Selling Rate: A total of 32 sales over the past year translates into a monthly selling rate of roughly 2.7 apartment sales per month in Royal Oak.

-

Months of Inventory: With 7 active listings at the time of this snapshot and the current selling rate, months of inventory sits near 2.6 months, indicating that buyers have room to compare options, while good listings still attract solid interest.

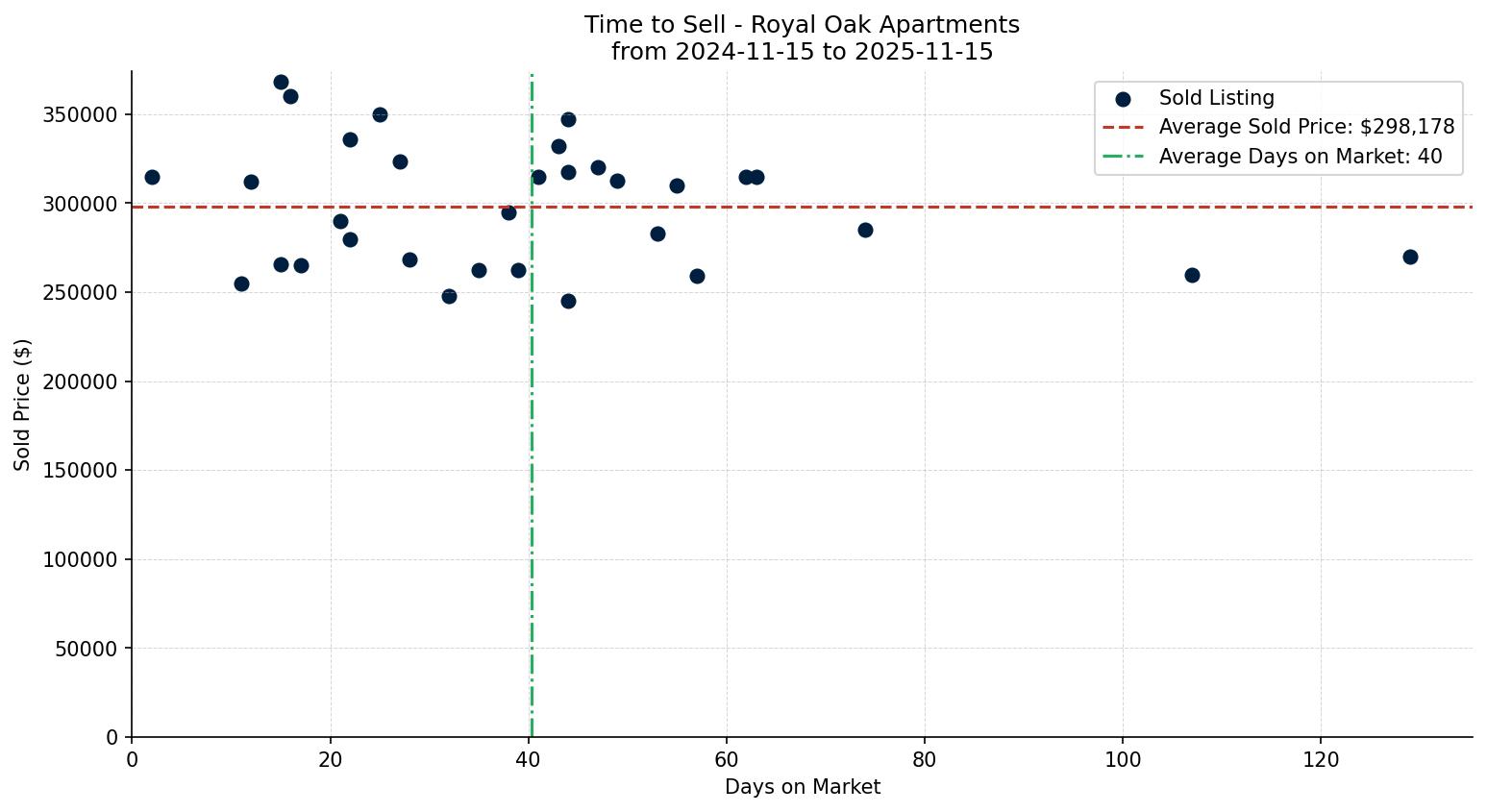

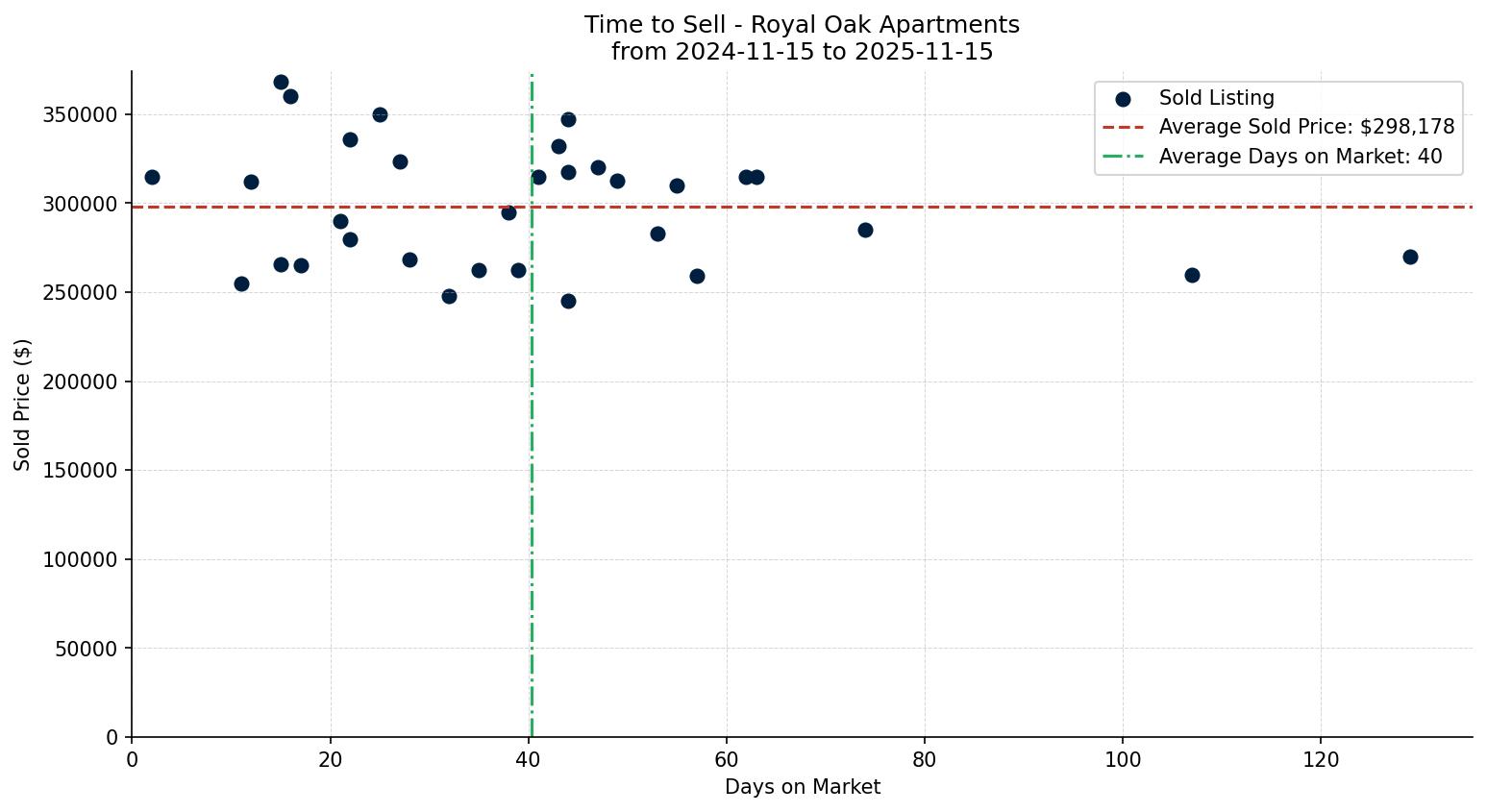

Time to Sell

The Time to Sell chart plots individual apartment sales in Royal Oak by days on market and sold price over the past 12 months, from 2024-11-15 to 2025-11-15. Each point represents one sold listing, with days on market on the horizontal axis and sold price on the vertical axis, plus reference lines showing the average sold price and a typical time on market for this segment.

-

Looking at the past year, apartment homes in this area have usually taken around 40.3 days to reach a firm sale. That’s a useful timeline to keep in mind when you’re planning your own move.

-

Sales that completed in less than about 21.8 days sit on the faster side of the chart and often reflect well-prepared listings that were aligned with recent pricing, while sales that took longer than roughly 50 days illustrate cases where extra time was needed before the right buyer and price match came together.

-

Across this period, the average sold price for apartment homes in Royal Oak has been near $298,178, and points that sit well to the right of the typical days-on-market line highlight situations where pricing, condition, or more specialized features required additional exposure before a firm sale.

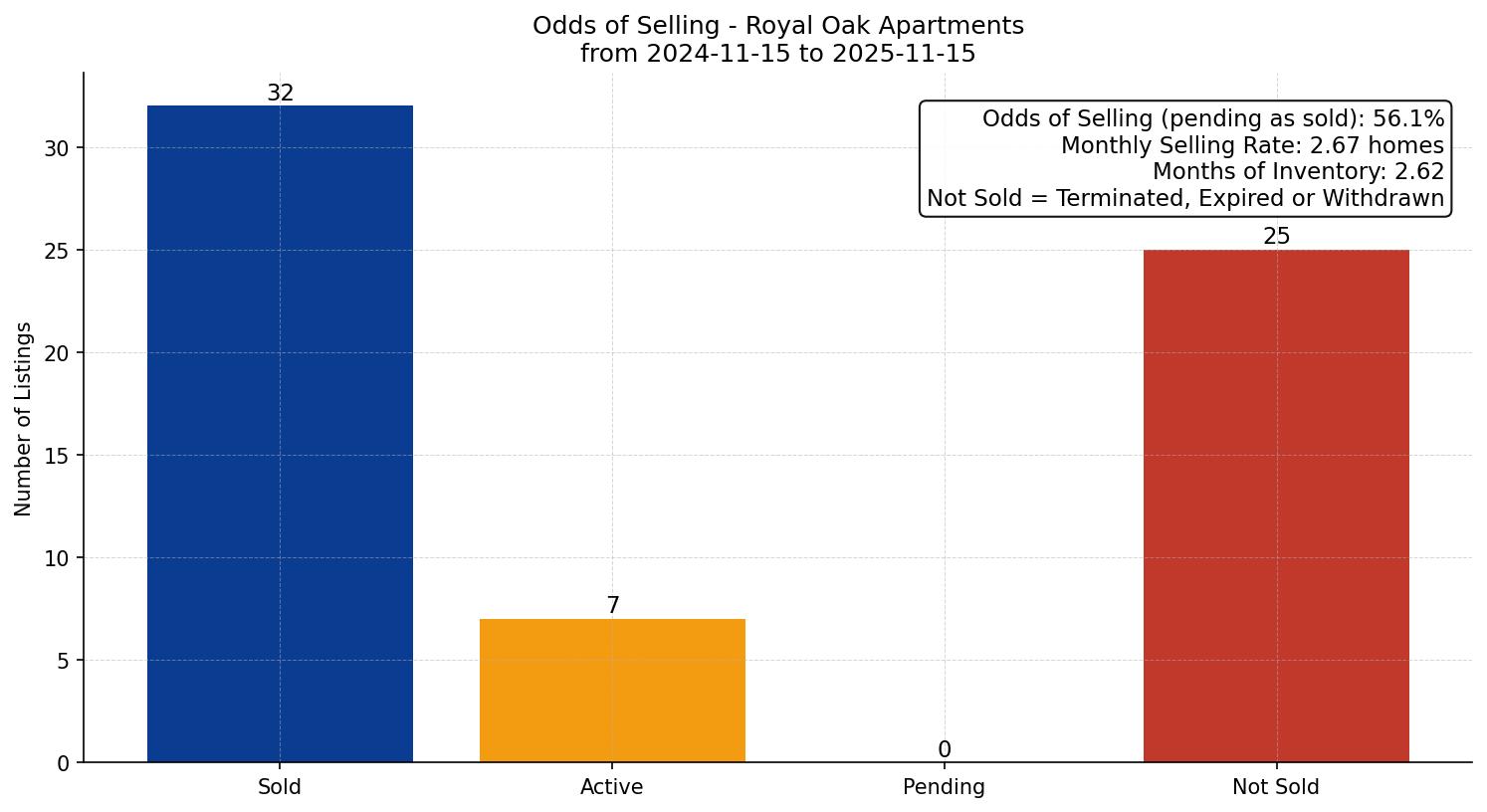

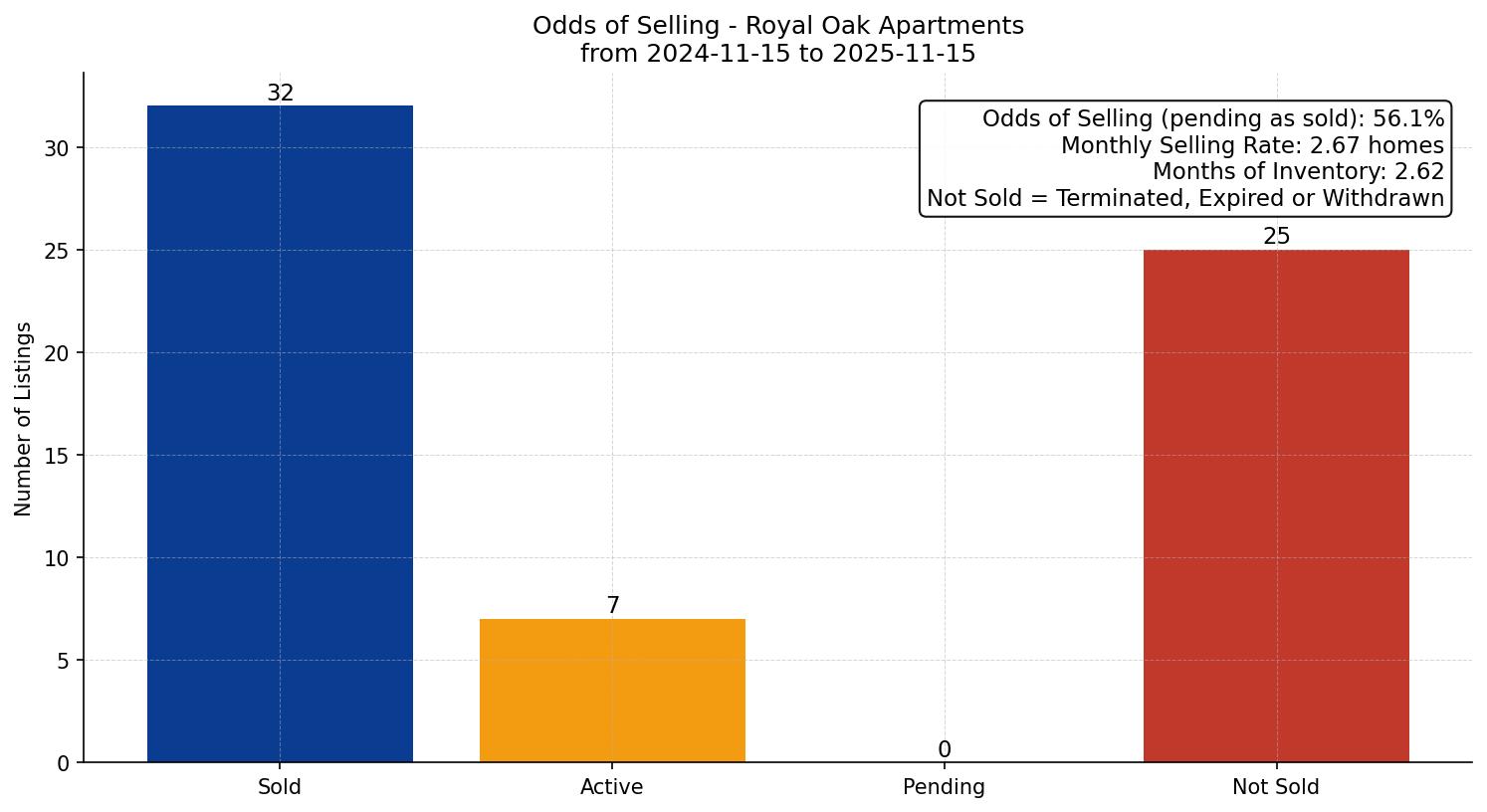

Odds of Selling

The Odds of Selling chart summarizes how many apartment listings in Royal Oak have sold, how many are still on the market, and how many were removed without a completed sale over the past 12 months, from 2024-11-15 to 2025-11-15. It also rolls those counts into an overall estimate of the percentage of listings that ultimately reach a firm sale.

-

Odds of Selling: Looking across these 12 months, 32 apartment listings in Royal Oak have successfully sold and 0 are part-way there, with 7 still on the market and 25 leaving the market unsold. Put simply, roughly 56.1% of listings have been making it all the way to a firm deal.

-

Monthly Selling Rate: When you smooth the results across the past 12 months, it comes to around 2.7 completed apartment sales per month, highlighting the underlying pace of demand in this segment.

-

With around 2.6 months of inventory derived from 7 active listings and the recent selling rate, buyers have room to compare options, while good listings still attract solid interest

-

In this context, “not sold” captures listings that were terminated, expired, or withdrawn without reaching a firm sale, which helps distinguish between properties that successfully completed the moving process and those that left the market for other reasons.

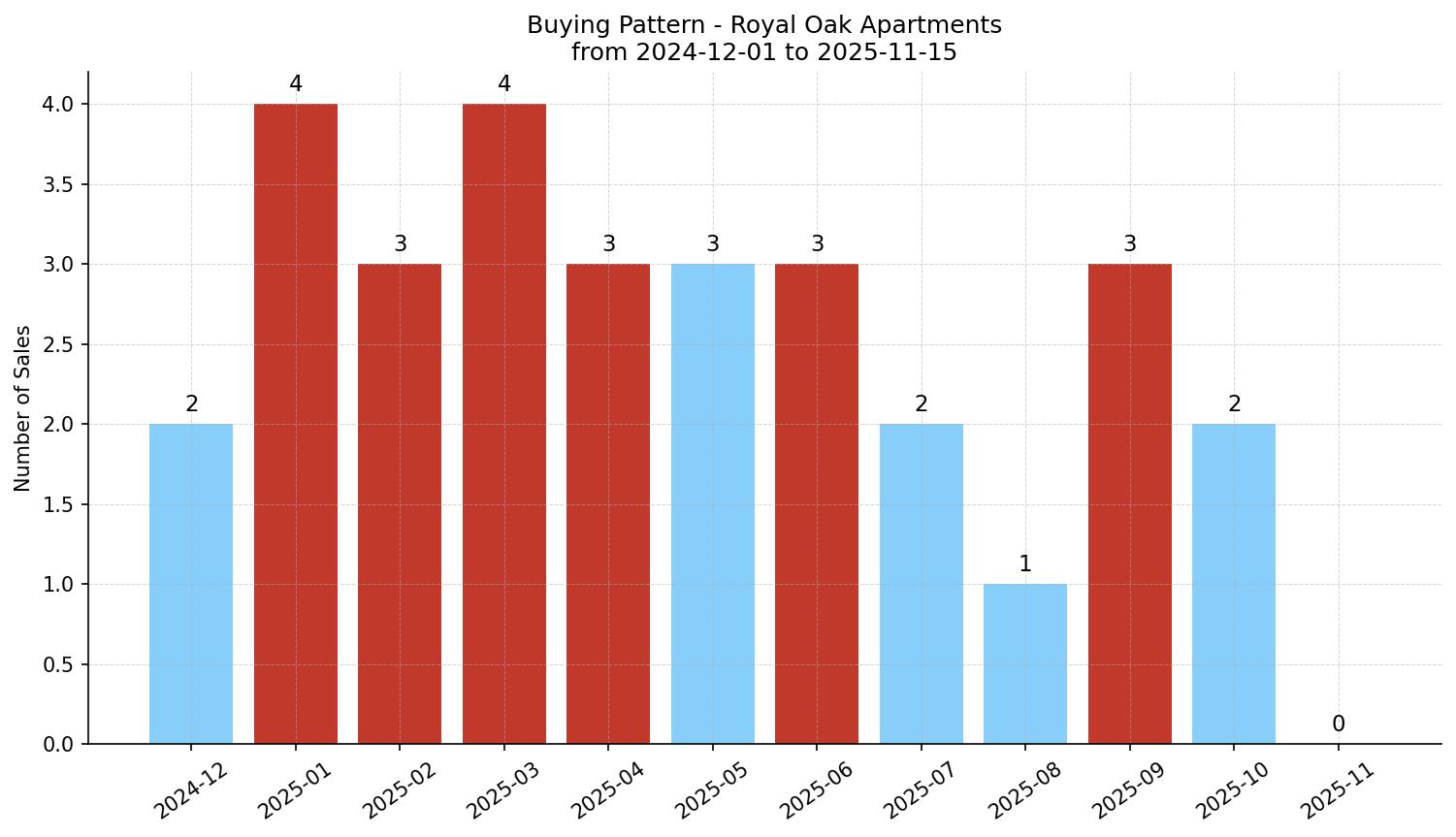

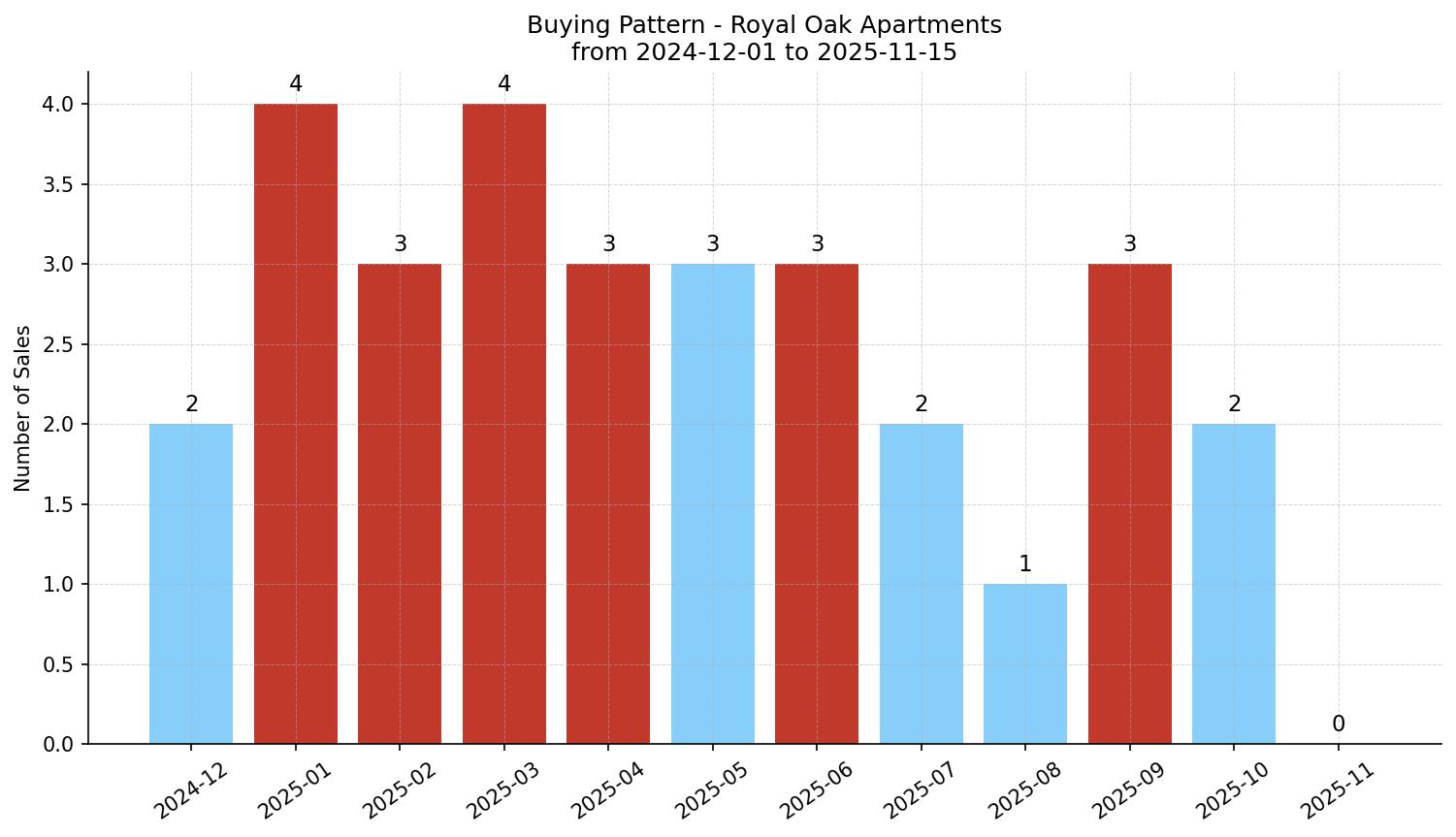

Buying Pattern

The Buying Pattern chart shows how many apartment sales in Royal Oak were completed in each of the last 12 months, including 11 full months plus the current month-to-date, so you can see how activity has moved through the year between 2024-11-15 and 2025-11-15.

-

The busiest months for closed apartment sales over this period were Jan 2025 and Mar 2025, where the bar heights sit at the top of the chart for this 12-month window.

-

On the quieter side, months such as Nov 2025 sit closer to the bottom of the chart, illustrating periods where fewer apartment sales were recorded.

-

Across the 12-month window, monthly closed sales ranged from about 0 to 4 deals, for a total of 30 completed sales. That lines up with the monthly selling rate of roughly 2.7 sales per month shown in the broader odds-of-selling view.

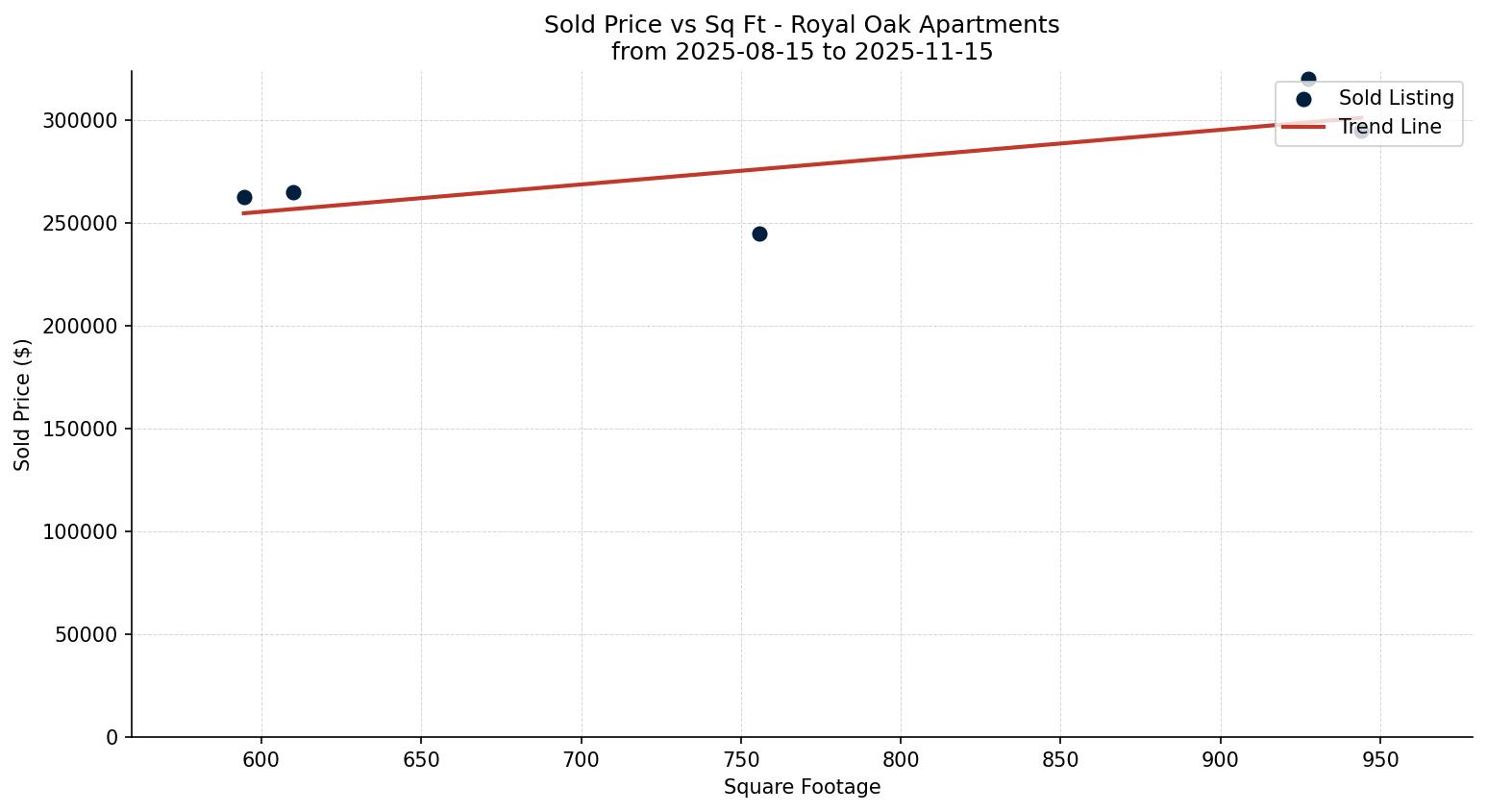

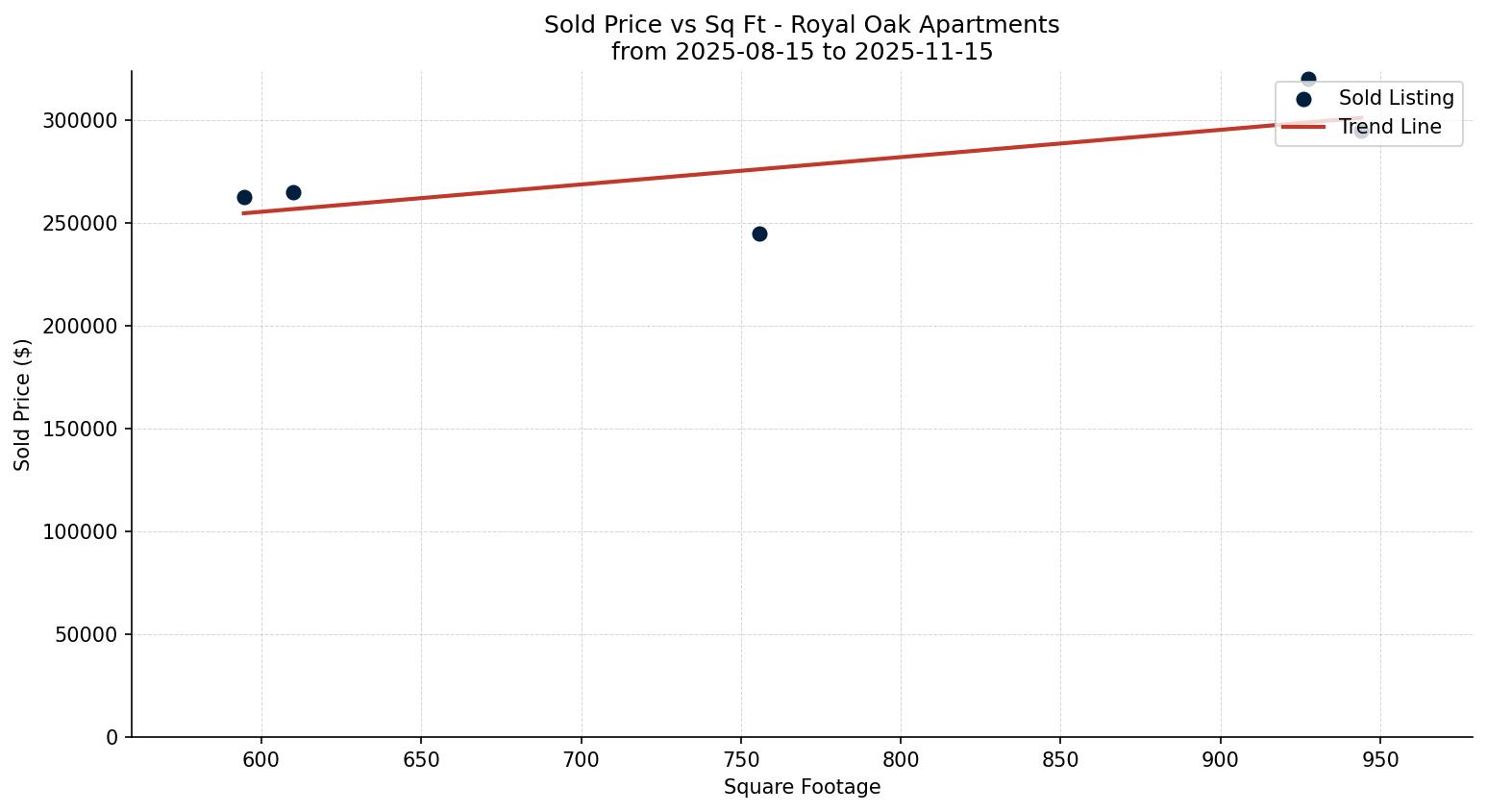

Price vs. Square Footage

The Price vs. Square Footage chart focuses on the last three months of apartment sales in Royal Oak, plotting each sale by interior size on the horizontal axis and sold price on the vertical axis. A trend line is overlaid to summarize how sale prices have tended to move as square footage changes in this recent sample.

-

Recent closed apartment sales in this view span from around 594.5 sq. ft. through to roughly 944 sq. ft., and within that range the trend line suggests a fairly strong relationship where higher square footage has recently been associated with higher sale prices.

-

Most recent apartment sales here have clustered in the core size range that many local buyers favour. That cluster helps show how extra space has been priced in real offers, rather than just on paper. The picture is based on roughly 5 sales from the last three months.

-

Taken together with the average sold price of roughly $298,178 over the full 12-month window, the chart can be used as a directional guide: you can locate a home's square footage on the horizontal axis, follow it up toward the trend line, and get a sense of where similar recent sales have been concentrating on the price scale.

Key Takeaways

-

Market tilt: With roughly 2.6 months of inventory, the apartment market in Royal Oak has been leaning toward seller-leaning conditions. That backdrop influences how quickly strong listings move and how firmly buyers can push on price.

-

Time to sell: The typical apartment listing in Royal Oak has taken around 38.5 days to firm up, which means the selling process has often required a longer marketing window before firming up; for planning purposes it is wise to allow for some variability around that median.

-

Size and pricing: Within the recent three-month sample, apartment sales from roughly 594.5 to 944 sq. ft. show a fairly strong relationship where higher square footage has recently been associated with higher sale prices. When estimating value for a specific home, it helps to pair that chart with the most similar recent comparables in terms of size, features, and condition.

Other Property Types in Royal Oak

Want to see the market trend for other property types in Royal Oak?

Considering a Move?

If Royal Oak is on your radar and you’d like a grounded take on how the apartment market is behaving right now, I can help you sort out your best next steps.

Buying: I’ll help you zero in on the right opportunities, compare the numbers, and move with confidence in the Royal Oak apartment market.

Selling: I’ll help you read the demand signals, tune pricing properly, and highlight the features that move buyers in this part of Royal Oak.

Want clear guidance shaped around your goals and timeline?

Let’s talk.